SERVICE Service

Introducing Our Six Core Services

We provide comprehensive support tailored to every stage of your business.

-

01

M&A

Support for M&A strategy development

Creation of long lists and short lists

Sell-side financial advisory (FA)

Buy-side financial advisory (FA)

Equity valuation (including valuation report preparation)

Contract negotiation advisory

-

02

Business Restructuring

Early-stage restructuring planning

In- court and out- of -court restructuring advisory

Equity sponsor search and contract negotiation advisory

Comprehensive restructuring support

Debt rescheduling negotiation advisory

-

03

Business Succession

Key considerations in business succession

Successor development and training

Equity and corporate structuring

Preliminary analysis of transfer feasibility

Successor search and contract negotiation advisory

- BEYOND ARCH PARTNERS

-

04

Regional Revitalization

Proposals for regional development strategies

Support for partnerships with urban corporations

Placement of highly specialized professionals

-

05

Global Expansion Support

Initial analysis of challenges in overseas operations

Acquisition and sale of overseas companies

Governance support for overseas subsidiaries

-

06

Management Support

Strategies for enhancing stock value and handling activist investors

Business portfolio restructuring

Support for Corporate Venture Capital (CVC) management

Geopolitical risk management

-

Growth Stage

(Business Value:↑) -

Maturity Stage

(Business Value:→) -

Decline Stage

(Business Value:↓)

Our Service

M&A

M&A strategy development, new business planning, M&A execution support

Business Restructuring

-

Business Succession

Business planning support (as a pre-succession measure)

Global Expansion Support

Overseas expansion support, M&A with international companies

Regional Revitalization

-

Management Support (Stock value enhancement project support)

Stock value improvement strategy development, support for Corporate Venture Capital (CVC) management, handling activist investors, business portfolio restructuring (selection and focus), geopolitical risk management

Our Service

M&A

M&A strategy development, M&A execution support

Business Restructuring

-

Business Succession

M&A support for business succession to large corporations, successor development and training

Global Expansion Support

・Overseas expansion support, M&A with international companies

・Exit support from overseas markets, dissolution of international partnerships, governance support for overseas subsidiaries (including labor management)

Regional Revitalization

Support for partnerships with urban corporations, placement of highly specialized professionals

Management Support (Stock value enhancement project support)

Stock value improvement strategy development, support for Corporate Venture Capital (CVC) management, handling activist investors, business portfolio restructuring (selection and focus), geopolitical risk management

Our Service

M&A

M&A strategy development, M&A execution support

Business Restructuring

Sponsor search, creditor negotiations

Business Succession

Successor search, creditor negotiations

Global Expansion Support

Exit support from overseas markets, dissolution of international partnerships, governance support for overseas subsidiaries (including labor management)

Regional Revitalization

Development of restructuring scenarios, business sponsor search

Management Support (Stock value enhancement project support)

-

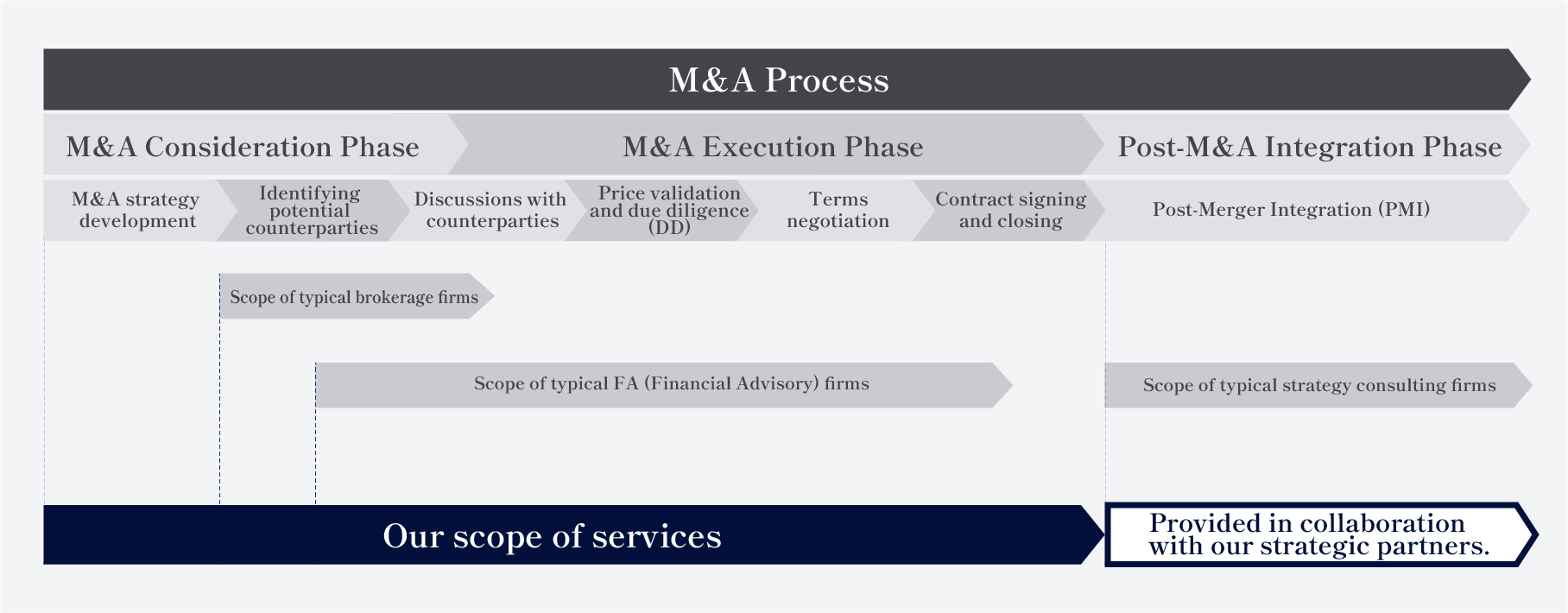

01

M&A

We offer high-quality advisory services across the entire M&A process to ensure successful outcomes.

-

Support for creating a long list

Support for creating a short list

Assistance in identifying M&A target areas

Support for approaching target companies

Assistance in preparing initial proposals

Initial synergy assessment support

-

Overall process management and execution support

Search and approach support for potential buyers

Coordination and negotiation with counterparties and their FA

Business plan validation support

Verification of financial statements for sale targets

Support for preparing the initial Letter of Intent (LOI)

-

Due diligence (DD) arrangement support

Business and equity valuation

Consideration of transaction methods and structure

Support for negotiating various contracts

Assistance in preparing the final Letter of Intent (LOI)

Support for creating public disclosure materials

Assistance in preparing internal briefing materials

-

Closing progress management

Support for negotiation and execution of ancillary agreements

Execution support for transition-related tasks

Risk and governance management

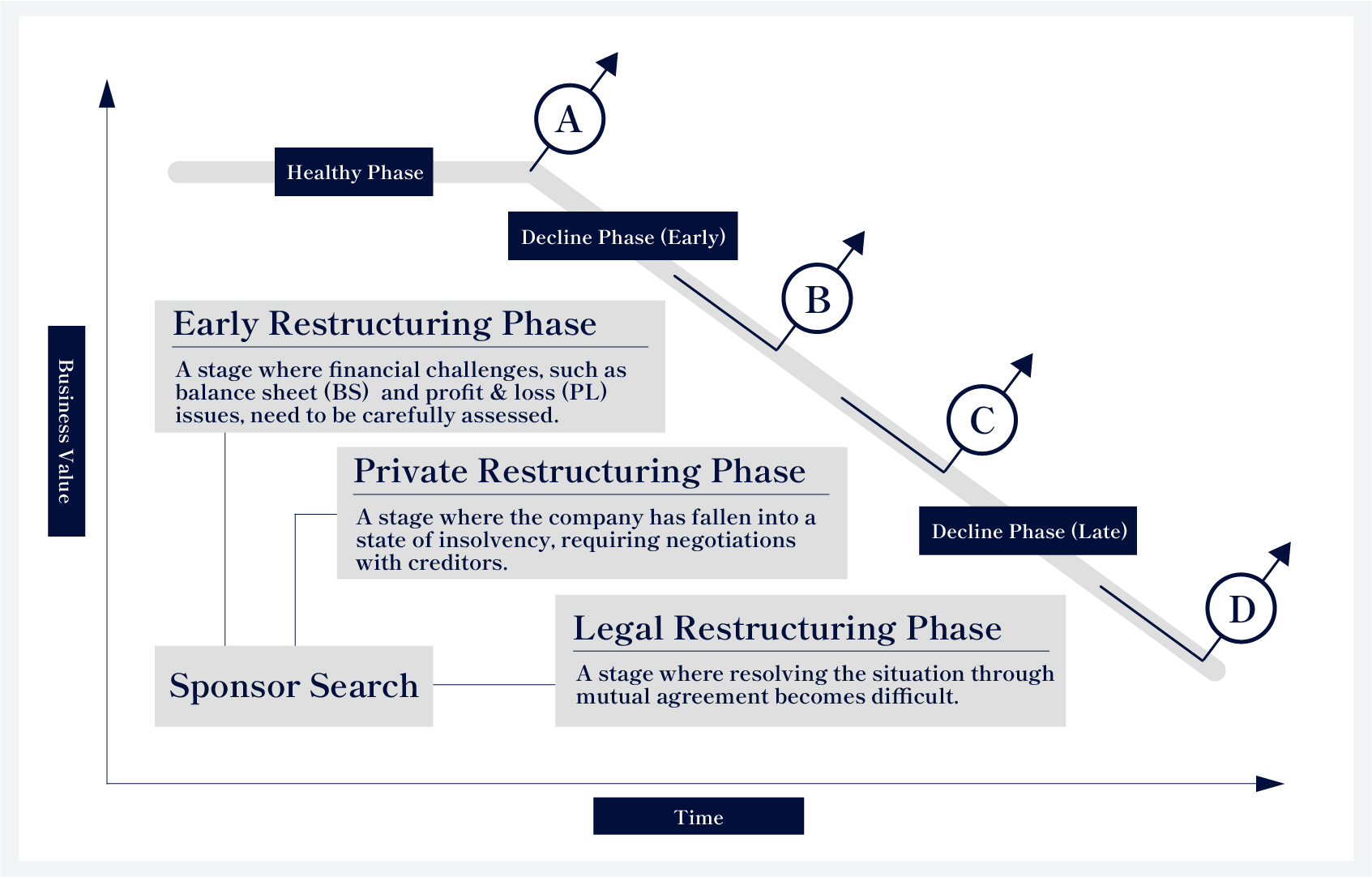

02

Business Restructuring

We provide the necessary restructuring procedures tailored to each phase of the business recovery process.

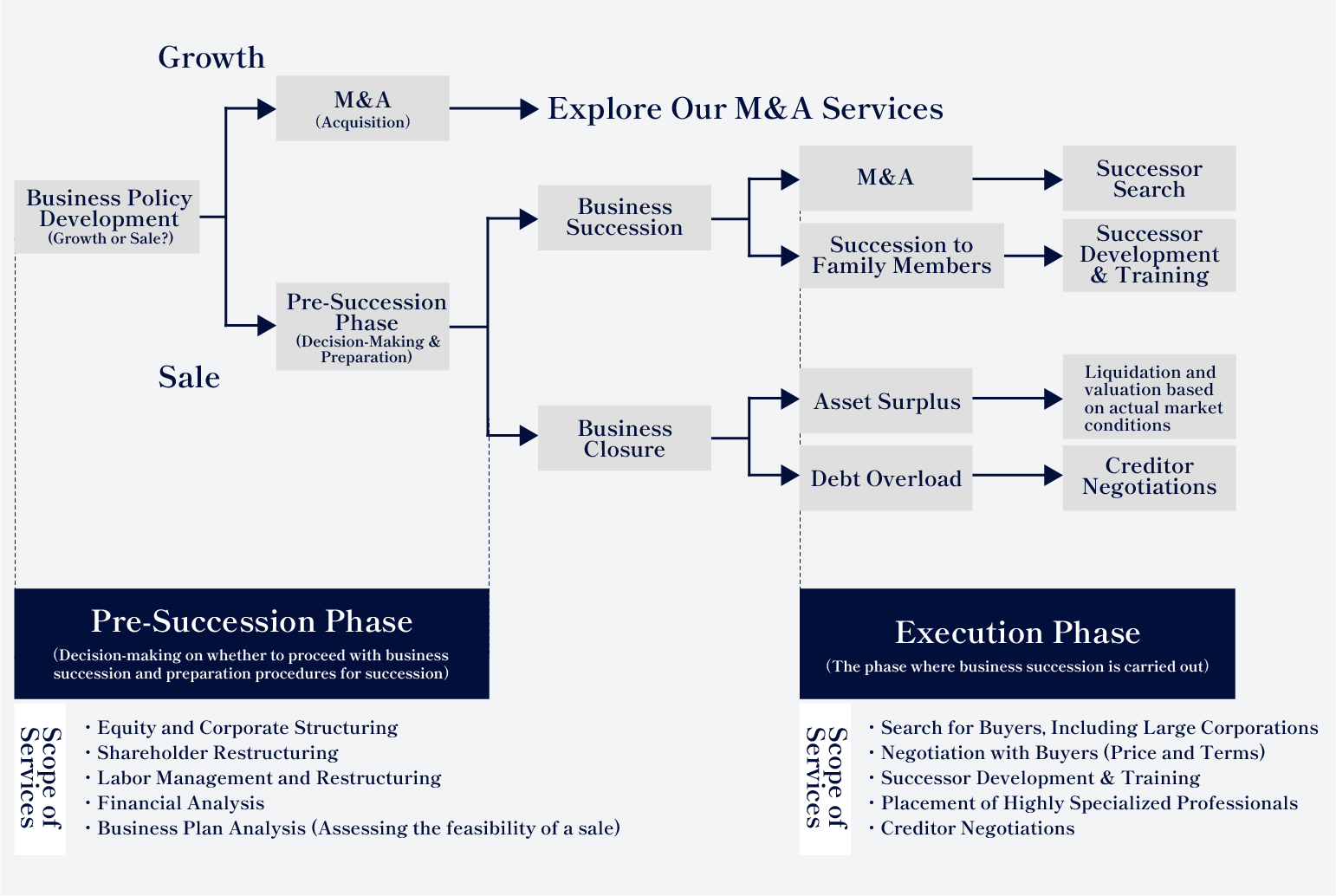

03

Business Succession

We provide advisory services throughout both the pre-succession and execution phases.

04

Regional Revitalization

We support regional companies facing various challenges by facilitating partnerships with urban corporations, overseas businesses, and neighboring enterprises.

-

01 Declining Total Population

Decreasing Ratio of Working-Age Population Due to Aging Society

Workforce Shortages

-

02 Work Environment Challenges for Regional Companies

Limited Employment Opportunities (Fewer job openings)

Availability of Attractive Jobs for Job Seekers

Lack of Infrastructure for Remote Work (Working for urban companies while living in a regional area)

Differences in Compensation Compared to Urban Companies

-

03 Living Environment Challenges in Regional Areas

Declining Population and Workforce Leading to Reduced Revenue

Decreased Revenue Resulting in Reduced Public Services and Infrastructure Deterioration

Convenience Gap Compared to Urban Areas

Overall Decline in Regional Attractiveness Due to These Factors

-

04 The outflow of talented young professionals to urban areas due to insufficiently developed work and living environments

Current Realities and Challenges for Regional Companies

A negative cycle where the loss of skilled talent to cities accelerates further population decline in regional areas

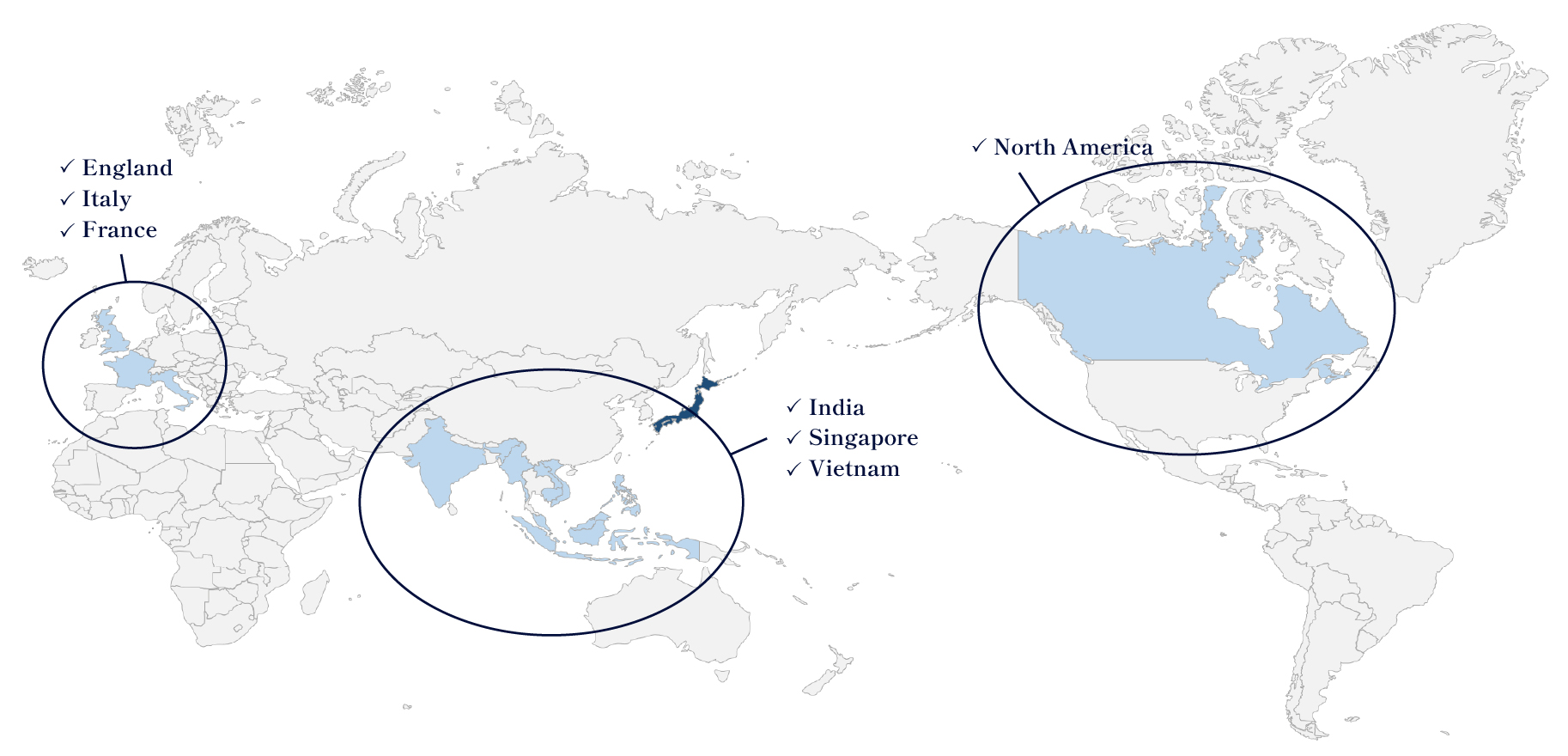

05

Global Expansion Support

We provide support for both expanding into international markets and withdrawing from overseas operations.

Main Target Regions North America, Europe, India, Singapore, Vietnam

-

Challenges in Overseas Expansion

① Identifying Potential Overseas Business Partners

② Complexities of Acquiring Overseas Companies (M&A)

Geographic and language barriers

Differences in M&A practices and business approaches

③ Establishing Management and Governance Systems for Overseas Subsidiaries & Assessing Feasibility

④ Decision-Making for Overseas Expansion

⑤ Labor Issues (Differences in compensation and benefits between domestic headquarters and overseas branches)

⑥ Geopolitical Risks

-

Challenges in Overseas Withdrawal

① Dissolving Partnerships with Overseas Companies

② Terminating Contracts with Overseas Business Partners

③ Labor Issues (Unpaid overtime, severance payments, etc.)

④ Litigation Risks

⑤ Geopolitical Risks

06

Management Support

As a strategic partner, we support management in stock value enhancement projects.

- Common Challenges

-

Strong business performance, but stagnant stock price

Struggling to break out of a low Price-to-Book Ratio (PBR)

Stock valuation indicators (EPS, PER, PBR, etc.) lagging behind industry peers

Launched a Corporate Venture Capital (CVC) initiative, but it remains inactive

Aiming for overseas expansion to develop new businesses, but lacking concrete plans

Presence of activist investors among shareholders

- Solutions We Offer

-

Support for Developing Stock Value Enhancement Strategies

Business Portfolio Restructuring (Selection and Focus) Support

Industry Peer Benchmark Analysis

Corporate Venture Capital (CVC) Management Support

M&A Department Operations Support

Geopolitical Risk Management

Cross-Border M&A Support

Handling Activist Investors